How to Keep Fruits and Veggies Fresh in the Summer Heat

Common Ways to Reduce Water Wastage at Home

Space-Making Hacks for Tidier Kitchen

Home Care: Tips to Take Care of Little Things

Learning Foreign Language - 10 Best Practices

Basic Financial Matters Every Woman Must Know

Smart Life Hacks for Young Women Professionals

Refrigerator Organizing Ideas for Indian Kitchen

Skin Care Routine After Steaming Your Face

How to Enjoy Slow Travel

Timeless Love Song Lyrics to Gift Your Partner

Engaging Facts About Engagement Ring

Mahatma Gandhi Quotes to Spread Love and Happiness

The Art of Slow Cooking: Myths vs. Facts

9 Vital Caregiving Tips for Your Elderly Parents

How to Prevent Wastage of Water in Home Garden

DIY Ideas to Declutter Your Office Desk

Simple Tricks to Cope with 4 Difficult Emotions

8 Perfect Pearl Care Tips for Lasting Luster

Foot Care Products to Keep Feet Soft and Healthy

Home Office Decoration Ideas on a Budget

Cool Travel Gear for Women on Solo Trip

Handy Meal Prep Tools for Home Chefs

6 Types of Exfoliants to Meet Your Skin Care Needs

Stylish Storage for Your Fashion Accessories

Blissful Massagers for Ultimate Relaxation

Glam Up Your Look: Must-Have Makeup Essentials

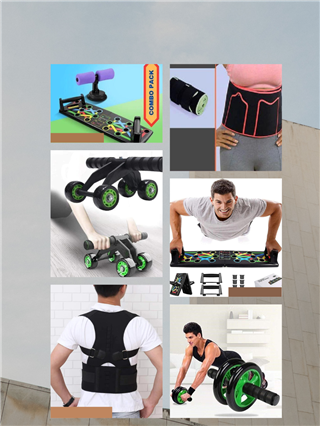

Fitness Made Simple: Your Go-To Source for Workout Essentials

Beauty Tools & Accessories for Effortless Elegance

Stunning Home Decor Items for a Stylish Makeover

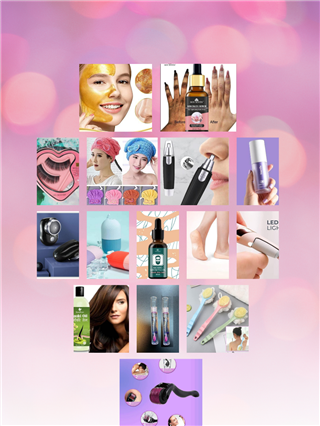

Pamper Picks: Personal Care Gems for Effortless Beauty

Necklaces & Chains for Showstopping Style

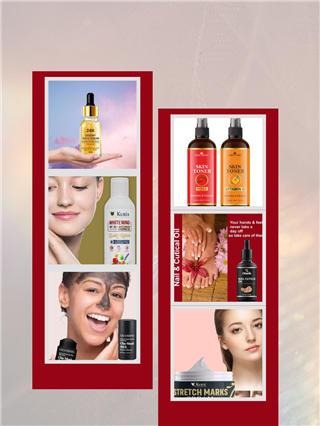

Glow Beyond Measure: Unveiling the Secrets of Skin Care

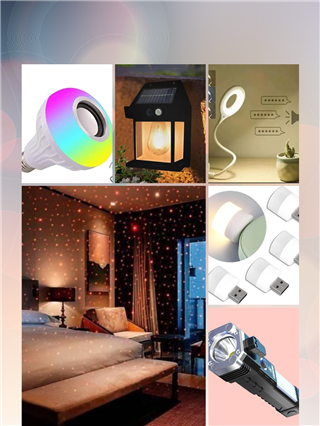

Brighten Your Space with Smart Lighting Magic

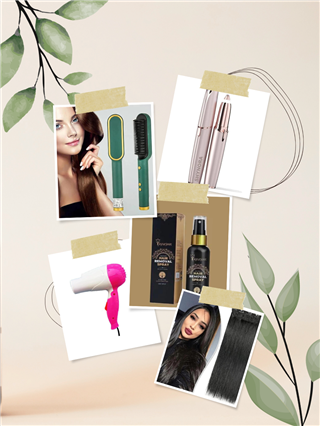

Hair Care Essentials for Radiant Tresses

Fabulous Finger Rings for Women

.png)